Guyana Compliance Commission Act 2023 Business Guide

Guyana Compliance Commission Act 2023 Business Guide

Introduction

Have you heard? On August 4, 2023, the National Assembly of Guyana stamped its approval on the Guyana Compliance Commission Act 2023. If you’re in the private sector—whether you’re a credit union, a law firm, or even a non-profit—listen up. This new legislation could change the way you do business.

What is the Guyana Compliance Commission?

Think of this Commission as the new sheriff in town. Created as an independent statutory body, it’s mandated to oversee non-financial businesses and non-bank financial institutions. Why? To make sure you’re following the rules, especially concerning Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT).

Don’t Let Your Money Become a Tool for Bad Guys: Understanding AML and CFT

Now, let’s talk about something critical, something that should concern us all. You’ve probably heard the terms “money laundering” and “financing terrorism” in movies or on the news. These aren’t just Hollywood terms; they are real-life issues that can taint innocent money. Money laundering is when bad guys try to make their “dirty money” look clean by moving it around through different banks or businesses. Imagine you’re painting a room, but instead of walls, you’re coloring money to hide its true, illegal origins.

So, what should you do? First and foremost, be vigilant. If you’re running a business, be cautious when handling large sums of money from unverified sources. The same goes for strange, large transactions that don’t seem to have a clear reason. By doing so, you’re not just protecting your business, but you’re also making it harder for criminals to exploit financial systems.

Now, on to CFT—Countering the Financing of Terrorism. In simple terms, it means stopping money from getting into the hands of terrorists. Believe it or not, small donations from innocent people sometimes find their way into the hands of these malicious groups. A friend of mine thought he was donating to an NGO helping war victims; turns out, he was funding terrorism without even knowing it! So, double-check where your money goes. When you’re donating, especially online, ensure you’re giving to legitimate organizations. If in doubt, a quick Google search could save you a lot of heartache and legal trouble.

So here’s the deal: AML and CFT laws are here to protect us, but they can’t do it alone. It’s a collective effort. Let’s not let our hard-earned money be a tool for harm. If something feels off, don’t brush it off—report it. Because every cent that doesn’t go into the wrong hands is a victory in itself. And trust me, it feels good to be on the right side of this fight.

Decoding the Key Provisions of the Guyana Compliance Commission Act

Ensure that your business complies with Guyana Compliance Commission Act 2023. Call us to discuss.

Let me break this down for you: laws can be mind-numbingly boring but incredibly important. In Guyana, a law was passed that essentially created a watchdog organization. It’s called the Guyana Compliance Commission, and it has a huge responsibility: to make sure people and businesses are not laundering money or financing terrorists. So, what does this Commission do, and why should you even care?

How the Guyana Compliance Commission Functions, Anyway?

First things first, the Act turns the Guyana Compliance Commission into a legit, independent entity. Think of it as a person—a super-smart one whose sole job is to sniff out financial wrongdoings. It’s not part of any other organization; it stands alone. This independence is critical; it allows the Commission to do its job without outside influence. Trust me, you don’t want the wrong people pulling strings here.

Powers and Functions: The Nitty-Gritty

Next, let’s talk about the muscle and brainpower of this Commission. It has the authority to license and supervise businesses to ensure they’re not part of any shady money stuff. But that’s not all; it also has its eyes on international activities, helping other countries fight the same battles. It’s like your teacher not only checking your homework but also collaborating with other teachers to make the whole school better.

More Than Just Oversight

This Commission isn’t just a watchtower; it gets its hands dirty. It’s out there conducting tests, basically pop quizzes, to make sure businesses are playing by the rules. If a company isn’t, the Commission can enforce penalties. And get this, it has to cooperate with international bodies. So, if some overseas bank thinks it can get away with financing bad guys, they have another thing coming.

Delegation: Sharing the Load

Now, the Commission isn’t a one-person show. It can delegate tasks to committees or officers within its team, making it more efficient. However, when it comes to serious stuff like licensing, that power stays at the top. This ensures that the most critical decisions are made by the most experienced people.

Who’s in Charge Here?

Leadership matters, right? So, the Commission has a Chairperson and a Deputy Chairperson. These are the folks steering the ship, making sure it doesn’t go off course. They’re supported by a Chief Executive Officer, staff, and even outside experts when needed.

Show Me the Money!

Lastly, this Commission isn’t working for free. It has its own fund to make sure it can do its job without cutting corners. You wouldn’t expect a superhero to fight crime without a proper costume, would you? This fund is that costume—giving the Commission the tools it needs to protect us all.

The Guyana Compliance Commission is here to make sure that the bad guys don’t have an easy ride. Its creation, structure, and operation are more than just legal mumbo-jumbo; they’re part of the wall that protects you, me, and our money from being used for terrible things. So, when you hear about the Commission cracking down on a business or cooperating with other countries, know that it’s all for a good cause.

Registration Requirements

Corporate Compliance

Reporting and Registration: The Commission’s Iron Fist

Let’s zoom in on a fascinating part of this Commission’s role: registering and monitoring certain professionals. Yeah, you heard right! Accountants, lawyers, real estate agents—you name it. If they’re in the money game in any capacity, they need to register with the Commission. Why, you ask? Because it’s not just big corporations that can get involved in illegal money activities. Even your neighborhood accountant can be cooking the books, knowingly or not.

Why Registration Isn’t Optional

So, these reporting entities—your accountants, lawyers, and real estate agents—must register within a specific time frame set by the Commission. It’s not a suggestion; it’s a requirement. Ignore this, and there could be big trouble. This registration isn’t just a hoop to jump through. It’s a safeguard to make sure every financial move these professions make is transparent and above board. Think of it as a roll call in school; you have to be present and accountable.

The Stick Behind the Carrot

Now, here comes the juicy part. What happens if someone doesn’t follow the rules? The Commission isn’t all talk; it has teeth. If a reporting entity isn’t compliant, the Commission can take some pretty tough actions. We’re talking canceling, suspending, or revoking registrations. And if that’s not enough, it can also recommend that their licenses or memberships in professional bodies be suspended or revoked. This isn’t child’s play.

So, folks, if you ever thought laws like these are just pieces of paper, think again. They are the foundation of a system designed to keep our financial world clean and fair. Even those in trusted professions are not above these rules; in fact, they’re held to even higher standards. And if they don’t comply, the Commission has the tools and the power to make them regret it.

Who’s Who of Beneficial Ownership Requirements

Alright, let’s tackle another piece of this puzzle: beneficial ownership. Simply put, the Commission wants to know who really owns and benefits from your entity. You might be wondering, “Why do they care?” Well, it’s not just nosiness. Knowing who’s behind a business helps the Commission sniff out any suspicious or illicit activities. So, don’t think you can be all cloak-and-dagger about it. You’ve got to provide this information, and it better be accurate and updated.

Now, I can’t stress this enough: make sure your beneficial ownership information is up-to-date. Lives change. People move in and out of businesses. Maybe you’ve added a partner, or perhaps someone has cashed out. Whatever the case, update that information. Ignoring this crucial step could bring a world of pain, including legal repercussions. So, if you don’t want the Commission on your back, keep things transparent and current. Trust me, it’s easier to update a form than to untangle a legal mess.

Auditing: The Commission’s Secret Weapon

EICCIO Corporate Compliance

Let’s dive into another critical aspect of this Commission’s arsenal: the role of auditors. If you think you can just register and go on with business as usual, think again. The Commission demands that certain entities, particularly those with a higher risk profile, put internal audits and compliance officers into place. That’s not just a feel-good exercise. It’s a crucial part of ensuring that these businesses are sticking to the rules and not playing fast and loose with our financial system.

No Cutting Corners with Audits

So, here’s the deal: If the Commission considers you a higher-risk entity, you have to appoint an auditor. Not just any auditor, though. This person has to be approved by the Commission as being capable and a “fit and proper” individual. Every year, they’ll scrutinize your financials and your AML/CFT compliance functions. And you can’t drag your feet—these audited records must be sent to the Commission within three months of your financial year’s end. If you thought you could slack off once you register, you’re sorely mistaken.

A Game of High Stakes

But what happens if your auditor uncovers something fishy? Well, brace yourself because they’re mandated to report any issues like money laundering risks or other regulatory breaches straight to the Commission. Oh, and don’t even think about obstructing or hindering the audit. That’s not just a slap on the wrist—it’s a criminal offense. The system is rigged to ensure transparency and honesty, and auditors are the gatekeepers.

In summary, these audit requirements aren’t optional; they’re the backbone of a transparent, accountable financial system. They ensure that businesses aren’t just paying lip service to the law but are actually living up to it. And if they’re not, the Commission is geared up to take some pretty harsh steps. So, if you’re in this arena, you better play by the rules or prepare to face the music.

The Crucial Role of the Compliance Officer

Okay, folks, let’s talk about a job that’s critical yet often overlooked: the Compliance Officer. For those in reporting entities, especially the riskier ones, appointing a qualified Compliance Officer isn’t just good practice—it’s the law. And we’re not talking about choosing just any warm body to fill a chair; this individual needs to get a nod from the Commission first. This person becomes your frontline defense against dodgy transactions and legal headaches.

A Jack-of-All-Trades

Now, a Compliance Officer isn’t someone who just sips coffee and shuffles papers. Their responsibilities are huge, almost like they’re the Swiss Army knife of your operation. They train your staff on compliance, maintain a direct line of communication with the Commission, oversee the compliance manual, and file required reports. Yeah, it’s not a job for slackers. For small players, like sole traders, the Commission might let you off the hook and allow you to handle these functions yourself, but don’t take that as an invitation to cut corners.

The “Fit and Proper” Standard

And let me be clear: The Commission has a “fit and proper” test for the Compliance Officer. Just as we’d expect a goalkeeper to be agile and alert, we’d expect a Compliance Officer to meet certain standards. If they’re not up to snuff, they won’t get the Commission’s blessing. Period.

Whistleblowing is Not Optional, It’s Mandatory

If the Compliance Officer uncovers anything that smells like a regulatory breach or risk, they can’t just sweep it under the rug. They have to tell both the entity’s management and the Commission. That’s right, they’re obligated to spill the beans. We’re talking about a position of trust and accountability here.

Small Entity, Big Responsibility

In summary, while larger, riskier entities will likely need a separate Compliance Officer, smaller entities may get some leniency based on their size. However, don’t mistake this flexibility for laxity. No matter your size, the overarching rule is that you must abide by the Commission’s requirements, or face the consequences.

So, if you’re running a reporting entity or planning to set one up, get serious about appointing a top-notch Compliance Officer. Trust me, you don’t want to mess around with the Commission. Get it right, or risk getting booted out of the game.

Audit & Reporting

Annual audits are more than a recommendation; they’re a requirement. And the auditor needs to get a nod from the Commission. Discovering any financial foul play? The auditor has a duty to report it directly to the Commission.

Don’t Play Games with Noncompliance Penalties

Let’s talk about the Guyana Compliance Commission Act

Listen up, folks. The Guyana Compliance Commission isn’t messing around when it comes to breaking the rules. Noncompliance isn’t just a slap on the wrist; it’s a trip to the courthouse and a dent in your bank account. Take, for instance, the whole registration business. If you think you can get away without registering, think again. The Commission will slap you with a fine ranging from GYD 10 million to 25 million, and you could also find yourself behind bars for up to 5 years. And it’s not just about the initial registration; you’ve got to keep your details updated too. If you slack off, expect a fine of GYD 25,000 for every month you’re not up-to-date.

Audit Obstruction and False Information: A Road to Ruin

Now, let’s talk about audits. Nobody likes them, but they’re crucial for keeping things above board. If you obstruct an audit, that’s a one-way ticket to a GYD 20 million fine and potentially 5 years in the slammer. Fudging the facts won’t get you far either. Providing false or incomplete information to the Commission carries a penalty up to GYD 10 million and a prison term up to 3 years. Yeah, you read that right—3 years. And don’t even think about getting in the way of an authorized officer during an inspection. That’ll set you back up to GYD 3 million and could lock you up for 6 months.

The Bottom Line: Don’t Mess Up

Look, I’m not a scaremonger, but you need to understand that this is serious business. From administrative penalties that can go as high as GYD 10 million to daily fines of GYD 100,000 for ongoing non-compliance, the stakes are sky-high. Even dabbling in virtual assets after the allowed phase-out period can sink you with fines up to GYD 50 million and a 5-year prison term. So, let’s cut to the chase—follow the rules, keep everything transparent, and for heaven’s sake, don’t think you’re smarter than the law. It won’t end well.

International Teamwork: Not Just a Buzzword

Look, in today’s world, bad actors don’t just operate within one country’s borders. They’re international, so our countermeasures should be too. Thankfully, the Guyana Compliance Commission gets it. They have the power to work hand-in-hand with foreign agencies to boost compliance and keep tabs on cross-border shenanigans. It’s like having an extra set of eyes and ears abroad. Not just beneficial for Guyana, but also a win for foreign agencies that are fighting the same fight.

A Flexible Regulatory Framework: More than One Way to Enforce the Rules

Now, if you’re wondering, “Is the Commission the only sheriff in town?”, the answer is no. The Minister can appoint other bodies to join the regulatory rodeo. It means that if the Commission is swamped, or if another body is better suited for a specific task, the Minister can delegate responsibilities. This flexibility is fantastic because it makes the system more robust and less prone to bottlenecks. So, no excuses, folks. With multiple agencies potentially involved, compliance isn’t just recommended; it’s a must.

A Timeout for Virtual Assets: Here’s Why It Matters

Let’s talk about cryptocurrencies, stablecoins, and all that jazz. In simple terms, Guyana has hit the pause button on all this digital money stuff. Why? Because it’s crucial to have a rulebook that makes sense, and right now, they’re still writing that book. That’s why the law has laid down the law, specifying that until the end of 2025, a bunch of activities involving virtual assets are a no-go. We’re talking about exchanges, transfers, custody—basically, most of the things you’d want to do with digital assets.

The Phase-Out: A Buffer for Businesses

Now, don’t freak out if you’re already in this line of work. The government isn’t trying to ruin your business; they’re giving you time to wrap things up. You’ve got one month from when the law kicks in to tell the Commission what you’re up to. After that, you get another three months to wind down your operations. It’s like a “finish what you’re doing, but then you’ve got to stop” kind of deal. Honestly, it’s better than an abrupt, “stop right now,” don’t you think?

What You Can’t Do: A Laundry List of Don’ts

Under Section 72, the list of things you can’t do is pretty long. You can’t trade virtual currencies for real money or even other virtual currencies. You can’t transfer them or keep them safe for someone else. And don’t even think about joining the bandwagon of issuing new digital tokens or assets. Yeah, it might feel like a buzzkill, but these rules aim to protect everyone from financial mishaps and fraud. So, let’s bear with it for now, hoping for a more secure and regulated future.

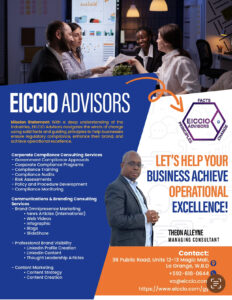

EICCIO Advisors

How EICCIO Advisors Can Be Your North Star in the Guyana Compliance Landscape

Navigating compliance is like walking through a maze, except this maze has legal consequences and hefty fines for taking a wrong turn. That’s where EICCIO Advisors come in. Picture them as your go-to guides in the compliance wilderness, with a compass that points only to “compliant.” These folks are more than just consultants; they’re like compliance superheroes who know the ins and outs of the Guyana Compliance Commission Act 2023. From registering with the Commission to preparing your company for internal or independent audits, they cover it all. It’s like having a guardian angel who whispers, “Hey, maybe don’t do that” right when you’re about to make a costly mistake.

Tailoring Solutions to Your Needs: It’s Not One-Size-Fits-All

What makes EICCIO Advisors a cut above the rest is the tailor-made approach they take. Let’s be real: not every company has the same needs or faces the same risks. EICCIO Advisors get that. They’ll look at your specific situation—maybe you’re a high-risk entity or a small mom-and-pop shop—and they’ll customize a compliance strategy just for you. They’ll tell you if you need a dedicated compliance officer or if your business can handle its own compliance affairs. Think of it as a bespoke suit, but for your business, ensuring you’re not just compliant, but also efficient.

Why You Should Care: Protecting Your Reputation and Bottom Line

Look, in today’s world, your reputation is gold. A single misstep, one violation, and you’re not just looking at fines; you’re also staring down the barrel of a reputation nosedive. It’s not just about obeying the law; it’s about securing your company’s future. With EICCIO Advisors, you’re not just buying a service; you’re investing in peace of mind. They’ll keep tabs on you, ensure you’re updated with the latest regulatory changes, and even assist you in international cooperation requirements. So, if you want to keep sailing smoothly in the complex waters of compliance, my advice? Call EICCIO Advisors.

Remember, EICCIO Advisors, led by former Wall Street Regulatory and Compliance Subject Matter Expert Theon Alleyne, specializes in navigating these complex regulatory and operational challenges. We can even act as your outsourced Compliance Officer. Reach out to us via WhatsApp at +592-618-0644 to arrange a consulting call.

Final Thoughts on the Guyana Compliance Commission Act 2023: A New Era of Accountability and Opportunity

Book a Consultation with EICCIO Advisors

The Guyana Compliance Commission Act 2023 isn’t just a set of rules; it’s a landmark shift in the way businesses operate, pushing them toward greater transparency, integrity, and international cooperation. For those who get it right, it’s more than just avoiding fines or jail time; it’s about gaining a competitive edge and building a reputation that stands for trust and reliability. Don’t view it as a hurdle but as a chance to elevate your business standards. With this Act, Guyana is pulling up its socks, and if you’re doing business here, it’s time you pull up yours too.

This isn’t just about being on the right side of the law; it’s about being on the right side of history. The world is becoming a smaller place every day, and regulatory compliance is the bridge that connects different markets and opportunities. Whether you’re a local entrepreneur or an international business magnate, the Guyana Compliance Commission Act 2023 levels the playing field. And remember, if the complexities make your head spin, specialists like EICCIO Advisors are ready to guide you every step of the way. So don’t just comply—excel.

Frequently Asked Questions about the Guyana Compliance Commission Act 2023

- What is the Guyana Compliance Commission Act 2023?

- The Act is a legal framework that governs Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) in Guyana. It establishes the Guyana Compliance Commission as a statutory body to oversee compliance among various reporting entities.

- Who needs to register with the Guyana Compliance Commission?Reporting entities like accountants, lawyers, and real estate agents must register with the Commission within a specified timeframe to continue their operations.

- What happens if an entity fails to register or comply?The Commission can cancel, suspend, or revoke an entity’s registration and recommend further penalties. Financial penalties can range from GYD 10 million to 25 million and/or imprisonment up to 5 years.

- What are the auditing requirements under this Act?Higher-risk entities may be required to appoint an auditor to examine financial statements and AML/CFT compliance functions. The auditor must report any discovered issues to the Commission.

- What are the responsibilities of a Compliance Officer?

- The Compliance Officer oversees staff training, reporting, and compliance procedures. They must also report any regulatory breaches or risks to the entity’s management and the Commission.

Frequently Asked Questions Continued

- What are the rules regarding beneficial ownership?

- Reporting entities must provide accurate and updated beneficial ownership information to the Commission, as part of their compliance obligations.

- Can the Commission cooperate with foreign counterparts?

- Yes, the Commission can exchange information and cooperate with foreign counterparts to improve compliance and supervision.

- What are the limitations on virtual assets like cryptocurrencies?

- The Act restricts and phases out most commercial virtual asset activities until December 31, 2025, or another date set by the Minister.

- How can EICCIO Advisors help in this context?

- EICCIO Advisors are experts in corporate compliance consulting. They can help businesses navigate the complexities of the Guyana Compliance Commission Act 2023, ensuring they meet all legal requirements and avoid penalties.

- Is the Act all about penalties and restrictions?

- While the Act does impose penalties for non-compliance, its broader aim is to bring about greater transparency and integrity in business operations, aligning Guyana with international AML/CFT standards.

Feel free to reach out if you have more questions. It’s essential to stay informed and proactive in ensuring your business remains on the right side of the law.

Recent Comments